The More You Now: Multi-dimensional Dashboards and Nowcasting as policy tools in an ever more volatile world

With Government bodies, policy makers, and institutions being entrusted with directing increasingly large shares of the collective public effort (as measured by GDP) there is an enormous public interest in ensuring that the right policies are implemented at the right time, and for an appropriate duration. This has led to greater demands for “evidence based policy-making” that is built on data that allows for better knowledge of the ground state of the economy. In this debate, GDP often finds a role in identifying what, and where, problems exists, it suggests what the scope for policy intervention might be, and helps assess the efficaciousness of policy interventions. This has led to calls for more and better and data about more elements of the world, and with greater frequency. Policy making has an extreme Business Information challenge as the problems that are encountered in that domain are typically wicked problems. This paper examines the role that GDP has played as data tool, how it was developed, adapted to novel use cases, and how attempts have been made to address its weaknesses. As the range and frequency of available data has increased over recent years, two major threads activity have been identified: Multidimensional dashboards of metrics that measure the things that GDP does not measure, and Nowcasting methods which seek to address the low-frequency of GDP information.

With the greater availability of data over recent decades governments and institutions have become increasingly interested in gathering and analysing new, richer datasets for the purpose of guiding public policy leading to strong claims regarding data’s “great economic potential and the necessity to exploit it” Rieder (2018). This is proving to be a challenging Business Intelligence task within the public policy domain. Simultaneously, the globally economic system seems to be becoming ever more volatile with leaders from Ireland Donohoe (2022) and globally Georgieva (2022) warning that we are living increasingly “shock-prone world”. This feeds into the demand for more data to support decision making. There are two principle ways in which the “more data” demand is being satisfied. The range of data that are being collected is extending – data are being gathered about factors not previously measured or integrated within policy-making – and, as most policy data are low-frequency, temporal gaps in data are being filled-in, either through integrating higher-frequency data into models earlier or by inferring the states of the variables of interest from other data.

Increased economic complexity/volatility has expanded the appetite for certainty, which has led to a greater desire for “Evidence Based Policy-Making” Parsons (2002). Policy makers have looked to the increasing availability of data to “support the grand edifice of modernised policy-making”, this is despite the fact that the presence of shocks suggests that historical data may not be a reliable guide for future policy. GDP is a metric which is often used to guide policy, and is a measure that was always considered contentious, even by its original creator. GDP has often been criticised by what it does not include or measure. Meanwhile, in countries such as Ireland, the information content of GDP has diminished as it has become decoupled from the underlying economic reality and new metrics have been developed in response FitzGerald (2020). As a result, to guide better decision-making attempts have been made to both measure GDP better – through integrating new data sources – and to measure it along other factors. This has led to broadening of the range of data that are being considered in conjunction with GDP through the use of multi-dimensional indices, or dashboards. The multi-dimensional approach has been complemented by the inclusion of newly-available, high-frequency, datasets which have given rise to “Nowcasting” to study short-run changes in GDP. This technique, which originated in meteorology Wilson et al. (1998) and was extended into economics Reichlin et al. (2005) and expanded by Banbura et al. (2010) “Nowcasting” attempts to predict “the present, the very near future and the very recent past” and has attracted interest as traditional economic data is low-frequency, often published either annually or quarterly. GDP is also built on composite data where elements of it are only available with a further time lag, Banbura et al. (2013). This paper looks at how this dynamic area of Business Intelligence has developed, some of the underlying assumptions in the field, and some caveats that have emerged within the literature.

1. GDP as a data solution to a Public Policy problem

Simon Kuznets created his National Income metrics on behalf of the US Secretary of Commerce, Danial Roper, in response to the economic and policy challenges that arose from the great depression, Kapuria-Foreman and Perlman (1995). Kuznets (1934) defined National Income as the difference between the total value of all “commodities produced” and “direct services rendered” less the total value of the “raw materials” and “capital equipment” that were expended.

where:

N I = National Income

Li= total economy-wide income of type i (e.g. wages, rents, disability payments etc.)

Cj = total value of the capital reduction across industry sector j (e.g. agriculture, construction etc.)

Kuznets highlighted the classification and the estimation data challenges that are replete within this measure, e.g. within businesses Kuznets:

• Contrasted the real losses in the accumulated capital within businesses with depreciation losses as described by accounting standards

• Discussed the issue of whether business losses were as a result of entrepreneurial retained income or actual capital loss, and

• Remarked on the problem of marking to market the value of inventories

To deal with the cross-sectoral variances in practice and data Kuznets emphasised what his assumptions were (e.g. the estimation of farm incomes) and the care that ought to be taken with interpreting the National Income metric, given the sectoral mix of the pre-WW2 US economy.

However, accepting these caveats, Kuznets was able to estimate:

(1) The changes in income and employment levels, by kind

(2) Industrial activity, by sector

and the approximate change in the relative shares of the total economy, between and within, both.

Kuznets National Income was a narrow metric that could be calculated from the exceedingly limited data then available. He emphasised the weaknesses it had with property related and entrepreneurial incomes and that the metric was a description of “the total activity of the national economy under one aspect” which was a mix of “relatively accurate and only approximate estimates rather than a unique, highly precise measurement”.

Despite these averred limitations, given the scale of the economic collapse Kuznets was able to demonstrate the accelerating pace with which the early-1930s US-economy was worsening. The report was used to support the expansionary fiscal policies of “The New Deal” and were key to his work for the War Production Board which saw an $17 Billion expansion of US National Income in 1942. Kuznets, however, lost control of his National Income creation which, transformed into into a metric of ’consumption’ metric Gross National Product (GNP), became tightly integrated with the Keynesian project Perlman (1987).

2. The decline in the utility of National Income/GDP as a meaningful metric

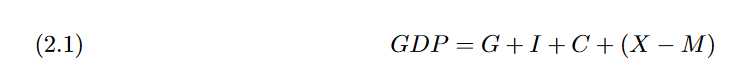

With the Bretton Woods agreement, Gross Domestic Product (GDP) – an adaptation of GNP that measures trade effects where:

where:

GDP = Gross Domestic Product

G = Total Government Consumption and Investment

I = Total Private Investment

C = Total Private Consumption

X = Total Value of Exports

M = Total Value of Imports

was hard-coded into the operations of institutions such as the World Bank and the IMF, Dickinson (2011). This led to the Kuznets (1948) review of the “National Income and Product Statistics of the United States 1929-46” which critiques the shift towards GDP.

Kuznets’ concerns were manifold, but included:

• The lack of a normative purpose for the metric;

• The treatment of government expenditure, taxation, and services;

• The double accounting that arises in the case of business expenditures which might also be

used for private consumption;

• The lack of detail on the variance of the data that are collected;

• The frequent revisions of data that have been produced; and

• The challenge of checking published estimates for consistency with other independent measures of the same quantity.

As can be seen from Formula 2.1 above, the calculation of GDP requires many measures across multiple sectors of society with differential reporting requirements, standards, and timelines. This can create a significant measurement issues, revisions in data are “large” and revisions “primarily reflect news not available at the time of the preliminary announcement”. Furthermore, the ways in which the GDP measure has been calculated has not been stable across time leading to the problem that “because data construction methods are constantly being revised, it is unclear whether past predictability is evidence of future predictability”, Faust et al. (2005).

Aside from the methodological concerns regarding the gathering of the data that are used, several other issues have been identified with what is being measured, and not measured, by GDP: Kuznets (1955) argued for what has come to be called the “Environmental Kuznets Curve”, Dinda (2004), wherein Kuznets hypothesised that the ecological costs which are associated with economic development have an non-linear relationship with GDP growth and so are a considerable externality for many developing countries as they grow. Giannelli et al. (2012) highlights another gap in the analysis of the contribution that people (almost exclusively women) make through unpaid domestic caretaking. Barro (2008) has examined between country inequalities that are obscured by GDP while Arnold and Blöchliger (2016) investigated within country inequality, and its impacts. The commensurability of the measure for comparisons between countries has been disputed, Castles and Henderson (2014), and Ireland in particular has experienced difficulty in applying the metric usefully, FitzGerald (2020), given the the large volume of foreign direct investment in the economy.

3. The Institutional Responses

Two broad responses to the inadequacies of GDP are apparent in the field, both emerge as a result of the greater availability of data. Firstly there is the trend toward multi-dimensional metrics and dashboards Stiglitz et al. (2010), the second trend is the analysis of high-frequency data, so called Nowcasting Banbura et al. (2013).

4. Nowcasting Methodological Techniques Multi-dimensionality tackles many of the primary critiques of GDP – those that pertain to GDP’s incompleteness as a metric. The introduction of the Human Development Index (HDI) in 1991, Ul Haq (1989) by the United Nations Development Programme, was a major move towards multi-dimensionality. This was, and remains, a contested action England (2021). The literature contains considerable debate regard what the HDI ought to included/exclude as the weighting of GDP per capita largely determines the rank order of countries. HDI calculations were amended in 1994, 1996, 2005 Wolff et al. (2011), and the methodology was reformed again in 2011. To complement this work the UN General Assembly passed the “Resolution 65/309 ’Happiness: Towards a Holistic Definition of Development” ’, 2011 which led to the annual compilation of the “The World Happiness Report” (2022). Paralleling the UN activity was the “Commission on the Measurement of Economic Performance and Social Progress” Stiglitz et al., 2009 and the EU Commission’s “GDP and beyond: Measuring progress in a changing world” Commission et al. (2009).

The Sitglitz’s report for the French Government was integrated into the OECD’s workplan, Stiglitz et al. (2010), Stiglitz et al. (2018) and was critical to the harmonisation process that underpins the UNECOE “Conference of European Statisticians recommendations on measuring sustainable development/United Nations Economic Commission for Europe; prepared in cooperation with the Organisation for Economic Co-operation and Development and the Statistical Office of the European Union (Eurostat)” (2014). This report stood back from the Composite Index approach of the HDI and highlighted 20 themes which impacted living conditions across three ’dimensions’.

• Human well-being – subjective well-being in the ’hear and now’

• Capital – future effects of present action

• Transboundary Impacts – effects on the well-being of those that live outside of the region under consideration

The EU’s Eurostat built upon this paradigm to create their “Quality of Life Indicators”, using an 8 + 1 approach to dimensionality, over 103 variables, which examines:

• Material living conditions – 13 metrics across three themes,

• Productive or main activity – 30 measures across three themes and eight sub-themes,

• Health – 16 metrics across three themes,

• Education – Six metrics across four themes,

• Leisure and social interactions – 20 measures across two themes and seven sub-themes,

• Economic and physical safety – Five measures across two themes and three sub-themes,

• Governance and basic rights – Five measures across three themes,

• Natural and living environment – Five measures across two themes, and,

• Overall experience of life – Three measures across two themes.

Source: “Quality of life indicators – measuring quality of life: Statistics explained” (2022) allowing for the comparison of all 27 EU states across each dimension and variable: “Eurostat – quality of life dashboard” (2022)

3.2. More measures more problems: A similar approach was taken with the UN’s Sustainable Development Goals for 2030 which arranges 120 metrics under 17 Sustainable Development Goals as part of the Annual Sustainable Development Report, “UN Sustainable Development Report” (2022).

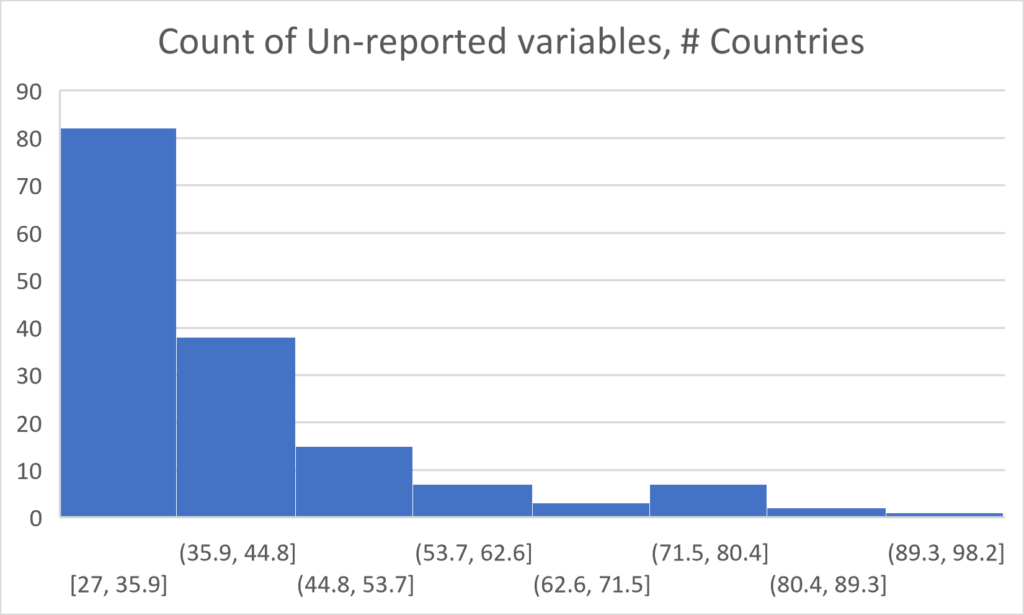

Data for many of these countries incomplete, with all countries not reporting at least some data. Looking at the 2022 report, “UN Sustainable Development Report 2022 Database” (2022), the minimum number of metrics where no data was available, across the 193 countries, was 27.

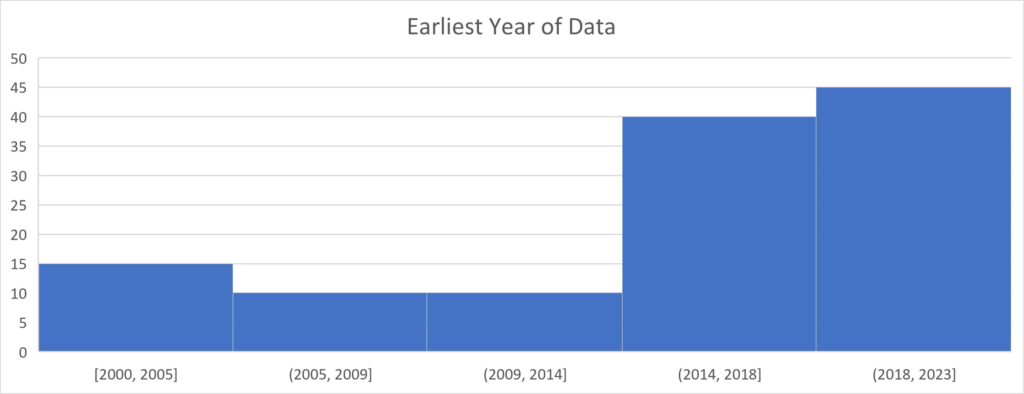

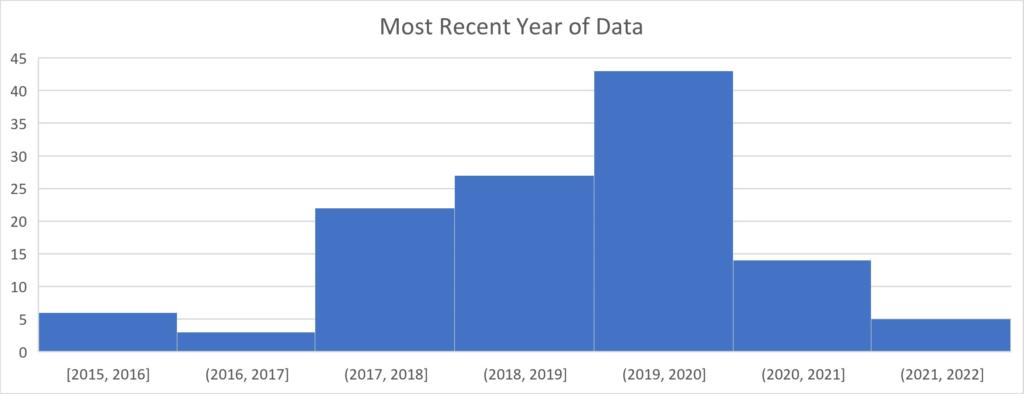

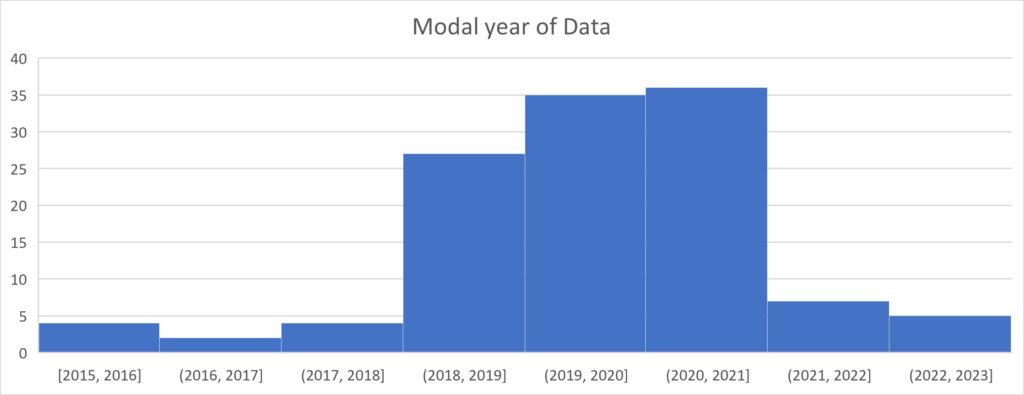

Furthermore 111 countries were missing data across more than 36 metrics, see Figure 1. Where data are available, their timeliness can be poor – there are instances where the most recent data from certain countries are in excess of 20 years old, see Figure 2. Where up-to-date data are available, it can be inconsistent, variables often comparing that extends across a number of years, see Figure 3. For 43 variables n the 2022 report the most recent year of available data was 2020, and for a further 58 variables the most up to data data was older still. Frequently, even where up-to-date data are available for some countries (for a specific metric) the data available for most countries is old. As seen in Figure 4, there are only five variables in the dataset where the 2022 report represents 2022, for 98 of the 120 metrics the modal year of the data lies in the range of 2018 to 2020.

3.3. Tempus Fudge-it, making up for lost times: In contrast to the international political institutions, with their attention on those things that are unmeasured, the international financial institutions, and literature, have focused on the temporal gaps in the GDP data. As early as “1937, national income figures began to be published in preliminary monthly form” Perlman (1987). The continuous demand for ever more timely data led the US Fed, and later the ECB, IMF, and numerous Central Banks to develop Nowcasting methods to track short-run GDP.

4. Nowcasting Methodological Techniques

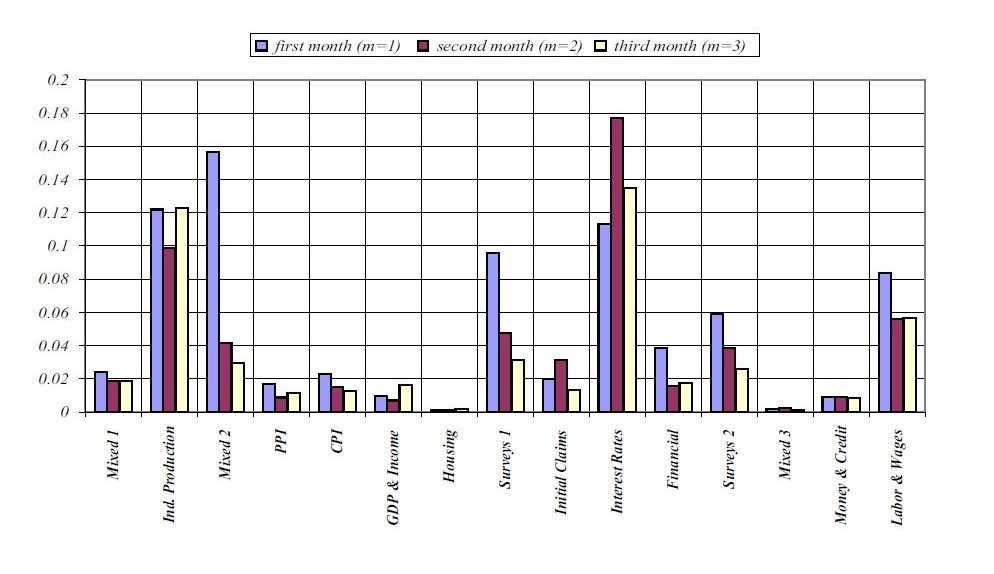

Reichlin et al. (2005) formalised Nowcasting as a method for estimating what is happening in the present. To do this they analysed the 200 macroeconomic components that are used to calculate the quarterly US GDP estimate. These metrics are sourced from 21 datasets which are published monthly or quarterly and have data that range in frequency from daily; weekly; monthly; or quarterly, and with a lag that can be nil; one month; two months; or quarterly. While these datasets are published almost exclusively on a monthly basis they are published at periodically over the month, and cover a range of sources from financial market data, surveys, money credit reporting, indices (like the Consumer Price Index) and employment figures. Where the data are available with a higher frequency that than monthly then a composite monthly value was determined. The authors transformed the data to remove the long term trends within the variables before reducing the dimensionality of the data and used Principal Component Analysis to estimating the “NEWS” component within each release at its given time within the quarter. They assumed that a set of common factors captured most of the information within the datasets, and that there was a set of variable specific error processes which introduced noise into the metrics (i.e. that the real economy

effect underlying the data had different but correlated effects on entities that could be measured but that each measure had its own error terms) and estimated these effects by examining data from 1982 onwards.

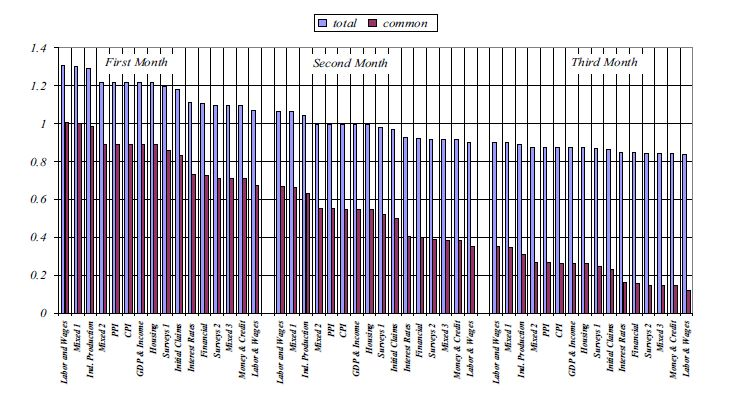

As can be seen in Figures 5 & 6 , from Reichlin et al. (2005), the authors were able to identify not only which variable had the greatest impact on the final composite indicator, but also when in the three month cycle they were likely to have the greatest signal vs. noise. Intuitively most variables carried less information as the quarter progressed just as the uncertainty reduces towards the end of the period (as can be seen in figure 6, by the same authors – where total is the uncertainty associated with the variable and common is the uncertainty of the signal as measured by the Kalman filter that weights the innovation content of each variable according to the real underlying shock vs the noise component).

The group then developed these methods, over a series of papers Giannone et al. (2008), Banbura et al. (2010), into a more fully developed methodology which defines Nowcasting as “the exercise of reading, through the lenses of a model, the flow of data releases in real time”, Banbura et al. (2013). Their model was characterised as a system of two kinds of equations:

• measurement equations that relate to latent state processes which cannot be observed directly and so their state must be inferred indirectly from measurable variables, and

• transition equations that model the state space of the of the economy

The output of this model then has the Kalman Filter applied to it to reduce the noise to make an estimate of the underlying latent state of the economy, given the available information set at a particular time, and the parameterised model of the economy’s state space. The main development in this updated model of Nowcasting methodology is the move away from Principal Component Analysis to estimate the parameters of the “Factor model”, and the move towards Maximum Likelihood Estimation to make these estimates as that allows for greater robustness regarding missing observations, different data publishing frequencies, asynchronous data releases covering periods of different duration, and data with non-normal fat-tailed distributions to include broader classes of real-time data.

By 2013, Nowcasting methodologies had travelled beyond the initial US Federal Reserve project to the ECB, the International Monetary Fund, various OECD Countries (including Ireland D’Agostino et al. (2008)), and China. Since then, Nowcasting projects have been implemented in numerous countries, though some such as Jain (2019) have argued that the Nowcasting ought to be complemented with even more diverse data sources. To this end, Galbraith and Tkacz (2015) introduced a methodology for using electronic payments data to predict GDP, while Kapetanios, Papailias, et al. (2018) outlined how big data is integrated into the Nowcasting process using a variety of methods (Mixed Data Sampling – MIDAS, using bridge models to predict absent low frequency data, and vector autoregressions (VAR) to model non-independent variable interactions), meanwhile Richardson, Mulder, et al. (2018) applied ensemble machine learning techniques to predict New Zealand GDP. And Bok et al. (2018) outlined how they built upon Giannone, Banbura et al’s Nowcasting model to create an implementation that runs daily and published weekly.

As the tools and techniques developed within Economics, the public health community identified similar tools for discovering domain relevant trends (prevalence, local infection rates) to advise on mitigation policies, Johansson et al. (2014), along with ever more sophisticated modelling techniques, McGough et al. (2020), and the introduction of novel data sources Lampos and Cristianini (2012). With the onset of the Covid-19 pandemic Conefrey, Walsh, et al. (2020), Goldsztejn et al. (2020), Günther et al. (2021), Hildebrandt et al. (2021), Kline et al. (2022), and Wu et al. (2021), Wu et al. (2020) etc. the gap between these areas of research these was bridged to help drive public policy measures through a period of high volatility and uncertainty.

4.1. Covid-19 and the spread of Nowcasting: During the Covid-19 pandemic Nowcasting became endogenised in the policy making process in Ireland: Conefrey, Walsh, et al. (2020), Egan (2022), and England (2021), and abroad: Berger et al. (2020), Cimadomo et al. (2022), and Mahler et al. (2022). However, the structural impact of Covid-19 also undermined some applications, like Bok et al.’s NY Fed Nowcast, and the publication of those results was suspended “Nowcasting Report” (2021)).

As a result of Covid-19, the application of Nowcasting broadened in three ways. Rather than merely forecasting the present and recent past Nowcasting became an input into the policy decision-making processes Kline et al. (2022), it also became a means of measuring the efficacy of public policy decisions Brum and De Rosa (2021), and has expanded the range of policy areas it is used to address Mahler et al. (2022).

5. Feedback Required

Data and policy are deeply entangled, in attempting to respond to the wicked problems of the social sciences with data, we often transform a complex social science problem into a complex social science problem, and, a complex data problem. It has become at least as difficult to separate the impact of data on policy as it is to identify the impact of policies in the data. Both policy and data feed into each other, and so back onto themselves. It is clear from the discussions regarding multi-dimensional data that there are huge benefits to be realised from getting a better measure of the world guiding policy. Similarly, there are benefits to be derived from getting a better understanding of the worlds as it is right now. However, these measures must be weighed in the context of their limitations. The rapid integration of a novel, largely unverified, methodology like Nowcasting into the decision making process, without regard for the weaknesses that can underlie the data models are trained on is concerning.

During the Covid-19 pandemic, in response to uncertainty, policy makers reached to data for guidance and reassurance. This highlights one of the issues that have been raised, Coté et al. (2016), about the automation of policy making: That a ’no politics, just data’ paradigm that ignores biases in the collection and analysis of data, weaknesses in the quality of data, or makes assumptions about the robustness of a model may lead to negative outcomes. Rieder (2018) highlights both how attractive and ill-defined ’big data’ solutions can be, when they are imagined by policy-makers. But this is not unique to our time, Kuznets warned policy-makers about the risks of over-exuberance for GDP even as it was developed, and as Robertson and Travaglia (2015) notes, we may be in a data revolution, but this is not even the first data revolution.

We are at a dynamic stage of our econonomic and social development, where we are is still developing the tools that are needed to make sense of the data which that is being collected, processed, and analysed. Within the domain of policy-making, individuals and organisations are still learning how and when to apply complex data tools in the right way at the right time. To do so we must be clear-eyes about both their potential and their limitations.

References

Arnold, F., & Blöchliger, H. (2016). Regional gdp in oecd countries: How has inequality developed over time?

Banbura, M., Giannone, D., Modugno, M., & Reichlin, L. (2013). Now-casting and the real-time data flow. In Handbook of economic forecasting (pp. 195–237). Elsevier.

Banbura, M., Giannone, D., & Reichlin, L. (2010). Nowcasting.

Barro, R. J. (2008). Inequality and growth revisited (tech. rep.). ADB Working paper series on regional economic integration.

Berger, T., Morley, J., & Wong, B. (2020). Nowcasting the output gap. Journal of econometrics.

Bok, B., Caratelli, D., Giannone, D., Sbordone, A. M., & Tambalotti, A. (2018). Macroeconomic nowcasting and forecasting with big data. Annual Review of Economics, 10, 615–643.

Brum, M., & De Rosa, M. (2021). Too little but not too late: Nowcasting poverty and cash transfers’ incidence during covid-19’s crisis. World Development, 140, 105227.

Castles, I., & Henderson, D. (2014). International comparisons of gdp: Issues of theory and practice. Measuring and promoting wellbeing: how important is it

Cimadomo, J., Giannone, D., Lenza, M., Monti, F., & Sokol, A. (2022). Nowcasting with large bayesian vector autoregressions. Journal of Econometrics, 231 (2), 500–519.

Commission, E., et al. (2009). Gdp and beyond: Measuring progress in a changing world. COM

(2009), 433.

Conefrey, T., Walsh, G., et al. (2020). Measuring economic activity in real time during covid-19 (tech. rep.). Central Bank of Ireland.

Conference of european statisticians recommendations on measuring sustainable development/united nations economic commission for europe; prepared in cooperation with the organisation for economic co-operation and development and the statistical office of the european union (eurostat). (2014).

Coté, M., Gerbaudo, P., & Pybus, J. (2016). Introduction. politics of big data. Digital Culture & Society, 2 (2), 5–16.

D’Agostino, A., McQuinn, K., & O’Brien, D. (2008). Nowcasting irish gdp (research technical papers no. 9/rt/08). Central Bank of Ireland.

Dickinson, E. (2011). Gdp: A brief history. Foreign Policy, 3.

Dinda, S. (2004). Environmental kuznets curve hypothesis: A survey. Ecological economics, 49 (4),

431–455.

Donohoe, P. (2022). Ned 2022 scene setter: Economic and fiscal context [National Economic Dialogue]. https://www.gov.ie/en/press-release/e80a5-ned-2022-scene-setter-economic-and-fiscal-context-opening-remarks-by-minister-for-finance-paschal-donohoe-td/

Egan, P. (2022). Nowcasting domestic demand using a dynamic factor model: The case of ireland.

Applied Economics Letters, 1–6.

England, C. (2021). The mismeasure of progress: Economic growth and its critics. Taylor & Francis.

Eurostat – quality of life dashboard. (2022). https://ec.europa.eu/eurostat/cache/infographs/qol/

index_en.html

Faust, J., Rogers, J. H., & Wright, J. H. (2005). News and noise in g-7 gdp announcements. Journal of Money, Credit and Banking, 403–419. FitzGerald, J. (2020). National accounts for a global economy: The case of ireland. In The challenges of globalization in the measurement of national accounts. University of Chicago Press.

Galbraith, J. W., & Tkacz, G. (2015). Nowcasting gdp with electronic payments data (tech. rep.).

ECB Statistics Paper.

Georgieva, K. (2022). The imf ’s role in a more shock-prone world [2022 IMF-World Bank Annual Meetings]. https://www.imf.org/en/News/Articles/2022/10/14/sp101422-imf-managing-director-speech-to-the-plenary-meeting

Giannelli, G. C., Mangiavacchi, L., & Piccoli, L. (2012). Gdp and the value of family caretaking: How much does europe care? Applied Economics, 44 (16), 2111–2131.

Giannone, D., Reichlin, L., & Small, D. (2008). Nowcasting: The real-time informational content of macroeconomic data. Journal of monetary economics, 55 (4), 665–676.

Goldsztejn, U., Schwartzman, D., & Nehorai, A. (2020). Public policy and economic dynamics of covid-19 spread: A mathematical modeling study. PloS one, 15 (12), e0244174.

Günther, F., Bender, A., Katz, K., Küchenhoff, H., & Höhle, M. (2021). Nowcasting the covid-19

pandemic in bavaria. Biometrical Journal, 63 (3), 490–502.

Hildebrandt, A.-K., Bob, K., Teschner, D., Kemmer, T., Leclaire, J., Schmidt, B., & Hildebrandt, A. (2021). Corcast: A distributed architecture for bayesian epidemic nowcasting and its application to district-level sars-cov-2 infection numbers in germany. medRxiv.

Jain, A. (2019). Macro forecasting using alternative data. In Handbook of us consumer economics

(pp. 273–327). Elsevier.

Johansson, M. A., Powers, A. M., Pesik, N., Cohen, N. J., & Staples, J. E. (2014). Nowcasting the spread of chikungunya virus in the americas. PloS one, 9 (8), e104915.

Kapetanios, G., Papailias, F., et al. (2018). Big data & macroeconomic nowcasting: Methodological review. Economic Statistics Centre of Excellence, National Institute of Economic and Social Research.

Kapuria-Foreman, V., & Perlman, M. (1995). An economic historian’s economist: Remembering Simon Kuznets. The Economic Journal, 105 (433), 1524–1547.

Kline, D., Hyder, A., Liu, E., Rayo, M., Malloy, S., & Root, E. (2022). A bayesian spatiotemporal nowcasting model for public health decision-making and surveillance. American Journal of Epidemiology, 191 (6), 1107–1115.

Kuznets, S. (1934). National income, 1929-1932. In National income, 1929-1932 (pp. 1–12). NBER.

Kuznets, S. (1948). National income: A new version. The Review of Economics and Statistics, 151–179.

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review,45 (1), 1–28.

Lampos, V., & Cristianini, N. (2012). Nowcasting events from the social web with statistical learning. ACM Transactions on Intelligent Systems and Technology (TIST), 3 (4), 1–22.

Mahler, D. G., Castañeda Aguilar, R. A., & Newhouse, D. (2022). Nowcasting global poverty. The World Bank Economic Review, 36 (4), 835–856.

McGough, S. F., Johansson, M. A., Lipsitch, M., & Menzies, N. A. (2020). Nowcasting by bayesian smoothing: A flexible, generalizable model for real-time epidemic tracking. PLoS computational biology, 16 (4), e1007735.

Nowcasting report. (2021). https://www.newyorkfed.org/research/policy/nowcast.html

Parsons, W. (2002). From muddling through to muddling up-evidence based policy making and the modernisation of british government. Public policy and administration, 17 (3), 43–60.

Perlman, M. (1987). Political purpose and the national accounts. The politics of numbers, 133–51. Quality of life indicators – measuring quality of life: Statistics explained. (2022). https : / / ec .europa.eu/eurostat/statistics- explained/index.php?title=Quality_of_life_indicators_-_measuring_quality_of_life#The_8.2B1_dimensions_of_quality_of_life

Reichlin, L., Giannone, D., & Small, D. (2005). Nowcasting gdp and inflation: The real time informational content of macroeconomic data releases.

Resolution 65/309 ’happiness: Towards a holistic definition of development’. (2011).

Richardson, A., Mulder, T., et al. (2018). Nowcasting new zealand gdp using machine learning algorithms.

Rieder, G. (2018). Tracing big data imaginaries through public policy: The case of the european commission. In The politics of big data (pp. 89–109). Routledge.

Robertson, H., & Travaglia, J. (2015). Big data problems we face today can be traced to the social ordering practices of the 19th century. Impact of Social Sciences Blog.

Stiglitz, J. E., Fitoussi, J.-p., & Durand, M. (2018). Measuring what counts for economic and social performance. Organisation for Economic Co-operation and Development (OECD), Paris.

Stiglitz, J. E., Sen, A., Fitoussi, J.-P., et al. (2009). Report by the commission on the measurement of economic performance and social progress.

Stiglitz, J. E., Sen, A., & Fitoussi, J.-P. (2010). Mismeasuring our lives: Why gdp doesn’t add up. The New Press.

Ul Haq, M. (1989). Human development report. United Nations Development Programme.

UN sustainable development report. (2022). https://dashboards.sdgindex.org/map

UN sustainable development report 2022 database. (2022). https://dashboards.sdgindex.org/static/ downloads/files/SDR-2022-database.xlsx

Wilson, J. W., Crook, N. A., Mueller, C. K., Sun, J., & Dixon, M. (1998). Nowcasting thunderstorms: A status report. Bulletin of the American Meteorological Society, 79 (10), 2079–2100.

Wolff, H., Chong, H., & Auffhammer, M. (2011). Classification, detection and consequences of data error: Evidence from the human development index. The Economic Journal, 121 (553), 843–870.

The world happiness report. (2022). https://worldhappiness.report/

Wu, J. T., Leung, K., Lam, T. T., Ni, M. Y., Wong, C. K., Peiris, J., & Leung, G. M. (2021). Nowcasting epidemics of novel pathogens: Lessons from covid-19. Nature medicine, 27 (3), 388–395.

Wu, J. T., Leung, K., & Leung, G. M. (2020). Nowcasting and forecasting the potential domestic and international spread of the 2019-ncov outbreak originating in wuhan, china: A modelling study. The Lancet, 395 (10225), 689–697.