Mario Draghi “Italian inflation izza best inflation”

“Prediction is difficult, particularly about the future” :- Neils Bohr

The markets are not predictable, they never have been, and they probably never will be.

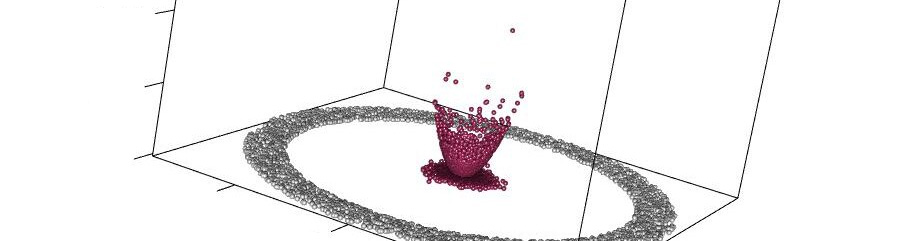

The most accurate predictor of today’s prices are yesterday’s prices, a concept know as “the random walk”. Prices today are approximately the same prices as yesterday, plus or minus some error – whether plus or minus, none can tell.

When new information arrives, this alters the beliefs of traders (what they believe the future holds in store for them), and they act. Their actions drive prices up, or drive them down. The upward or downward movement of price, and it’s amplitude is a function of this new information. If a 31 year old loses 2 Billion of your dollars this will have an effect, an obviously negative effect, on your share value.

This gets priced in, and the market moves onwards. When information enters the system it provokes change, the more new information, the more change and so the greater the volatility of the price.

This is why central bankers move slowly. There is a long courtship between the central bankers and the traders. Like the ugliest teens at a parish dance, they flash and signal to each other what their intentions might be – neither might be happy about where they might end up, but they have few alternatives. The only thing worse than going home alone, is the shock of being publicly rejected by someone fuglier than themself.

So they signal, tentatively they make eye contact, they smile, they wink, and they send their friends to sound the other out. They do this to scope out their potential futures eager to avoid sharp shocks.

Central bankers have had a tradition of moving calmly, slowly and signalling with coded phrases: “Strong vigilance”, heightened alertness”, etc. what their future intentions might be.

The mandate of the ECB is to support “price stability”. Broadly this is and anti-inflationary policy, but also a low volatility strategy.

With Super Mario, dropping an unexpected rate cut on the market, in response to the current chapter of the Greek crisis, can only lead to wider volatility on the stock markets, while also fuelling inflationary pressures (the ECB target inflation rate is 2%, the Eurozone rate is now 3%). This will also lead expectations to change, and expectations about the future are always priced today.

If Super Mario is to act so differently to his predecessor (and on his first day on the Job) then we can assume that the ECB’s hard limit on inflation has softened considerably. The future will have low-interest rates and high inflation – a good time to owe money. Unless I’m wrong – the future is the hardest thing to predict.