We need to kill this fiction that the debt that Ireland is on the hook for is sustainable. It is not, the only people who say that it is are the liars, the credulous, or the misinformed.

Last year, at the DEW Annual Policy conference, the chairman of the national fiscal advisory John McHale said that debt on Ireland’s books would top out at 120.3% He was wrong. Today the Debt is at 123%.

Prof McHale said that, all else being equal, there was a 60% chance that Ireland could pay off these debts (and optimistically assumed that good outcomes were at least as likely as bad outcomes, when making this projection).

A year on and this weekend sees another DEW Anual policy conference. Things are more fucked than they were, the policy makers are still thinking that hope will see us through, and we are more indebted than ever. The country is covered in “Green Jersey” bullshit once again, the government is hoping for 2% GDP growth, and this is despite the undemining of the GDP statistic by the accounting tranactions of the multinationals that have benefitted so much from our tax-haven loopholes.

In an era when the Gov’t is coming under an OECD level of pressure (i.e. the US is paying the OECD) to root out the gamification of the international tax environment, in the developed world. Making Noonan promise that Apple won’t be allowed to have stateless companies that allegedly comply with international treaties on taxation. When Pfizer can’t get a lift out of the Viagra patents, when Lipitor has dropped off patent too, when the HSE will have to reduce spending by almost 900million (they are booking last years overspend this year, and will carry up to 200million in 2013 overspending into next years spend, up from 140million last year), when they have already booked 250 million in savings through the Haddington Road. When all this, and more, is going on, the government hope that the GDP will increase.

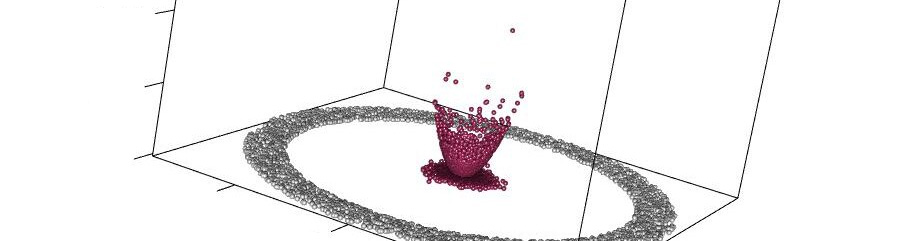

It might even do so. But even if it does, the country is growing more slowly than the debts it has to carry, and our debt flies along its unsustainable tragectory.

Making this worse, the country will have to refinance €80 Billion in debt by the end of the decade, and will have to borrow at least another €30 billion just to keep the lights on in the meantime.

And all of this fails to take notice of the 100,000 households who have had to give up paying their mortgages, the costs associated with settling this problem, the growing hole in the banks balance sheets as a result of missed payments. Then there is the ever extending hole in the Banks balance sheets, where the collateral for their mortgage loans (the houses) are still over valued (by about €40 Billion, at today’s prices).

A sink hole that will drag in so many more Billions if when the british banks finally decide to cut their losses, take possesion of all the houses of those who are more than 2 years behind in their mortgage payments, and ultimately dump them on the market.

These are things which are not talked about in Leinster House, because facing our shared reality is more uncomfortable than hoping that diminishing chance of everything working out alright in the end. They know that all this budget bullshit and debt drama, is a hail mary punt; that it is an unlikely outcome, and one that can only ever occur if, somehow, the rest of the world sorts out their own problems but somehow continues to believe our lies.